OmniDominion Global Empire Corp

OmniDominion Global Empire Corp

Welcome to OmniDominion Global Empire Corp

Your Premier Partner in Global Enterprise Solutions

Trafigura-The Intersection of Trade, Shipping and Finance

Founded in 1993, Trafigura is a leading global commodities trading and logistics services provider. Registered in Switzerland, its global operations headquarters are in Singapore, reflecting its strategic focus on the Asia-Pacific market. It transports oil, metals and minerals, natural gas, and electricity from production to demand, acting as the true resource orchestrator behind the global supply chain.

Imperial Trade

Trafigura's capabilities are particularly strong in the shipping sector. Its own shipping and chartering divisions manage a fleet of over 350 vessels, covering a wide range of transportation needs, from liquid energy to dry bulk. This scale not only ensures the flexibility and efficiency of Trafigura's own trading operations, but also secures a significant position in the global shipping landscape.

Worldwide service

Trafigura is also actively focusing on specific niche markets through acquisitions and joint ventures, strengthening its competitiveness in high-value-added transportation. A prime example is TFG Marine, a joint venture with a Norwegian shipping giant. This company focuses on providing low carbon, compliant marine fuel solutions for global vessels, helping the shipping industry achieve decarbonization.

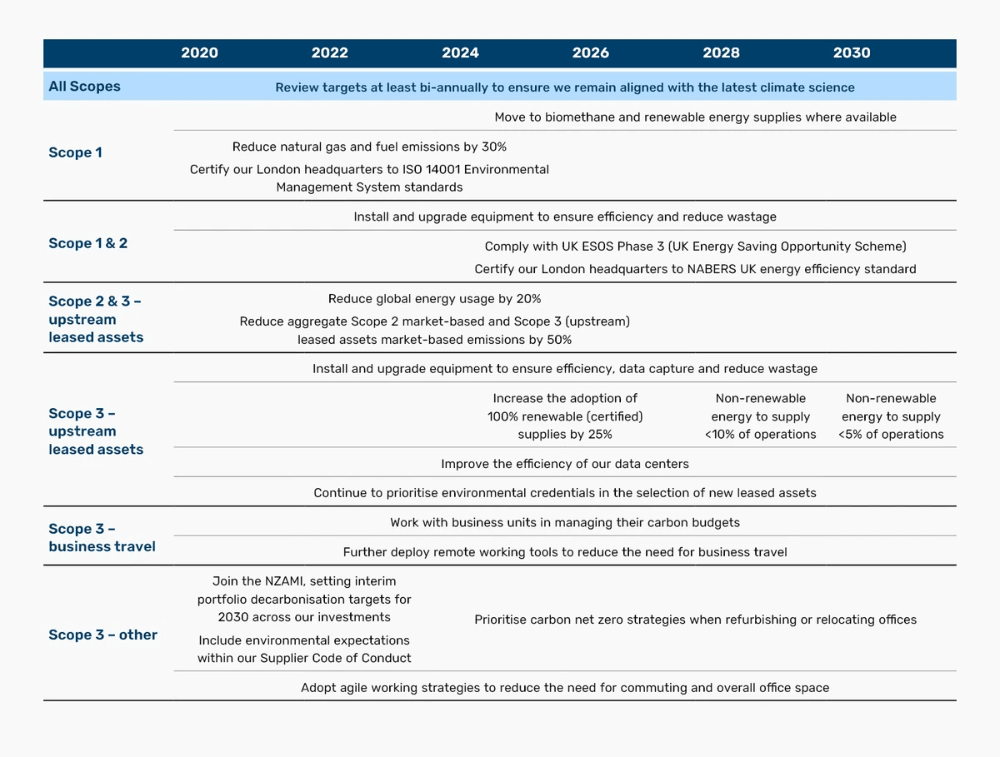

Managing our Environmental Impact. Our Commitment. Our Targets. Our Progress.

OmniDominion is committed to reducing its absolute carbon footprint and to being consistent and transparent about the progress we are making. As a key part of our Corporate Sustainability strategy, you can read more about how we manage our environmental impact in our Corporate Sustainability Brochure.

We continue to implement changes to our operations to ensure we are on track to meet our emissions reduction target set for 2024 and are on the strategic pathway to net zero carbon in our global workplaces by 2030.

Introduction

- CMAs seek to help allocators with their asset allocation decisions by establishing long-term forecasts for different financial assets. The problem is that they either fail to do this with much accuracy or make their forecasts with such a degree of caution that the output is of limited practical use.

- In this paper, we propose a framework to help allocators to calculate these assumptions for themselves, as well as explore some practical applications for the resulting data.

- A critical question that is not given sufficient consideration in our view is: what are you proposing to use CMAs for? There seem to be two options. First, allocators may have a liability window over the next 10 years, and want a base case for how assets might match these liabilities. Or secondly, they may want an unconditional base rate which serves as the foundation for ultra-long portfolio allocations. If the latter, and we suspect this is the case for most users, then the timeframe consideration becomes particularly important.

- In Part One, we discuss forecast timeframes. In Part Two, we describe four credible methods for determining CMAs. In Part Three, we use findings from the prior two sections to calculate a range of CMAs for US stocks and 10-year Treasuries (UST10). These assumptions allow us, in Part Four, to derive strategic asset allocations (SAA), based on optimisation parameters such as return, volatility drawdown and Sharpe ratio.

- In this paper we focus only on US equities and intermediate duration, as the two most consequential portfolio building blocks.

Part One: CMA timeframes

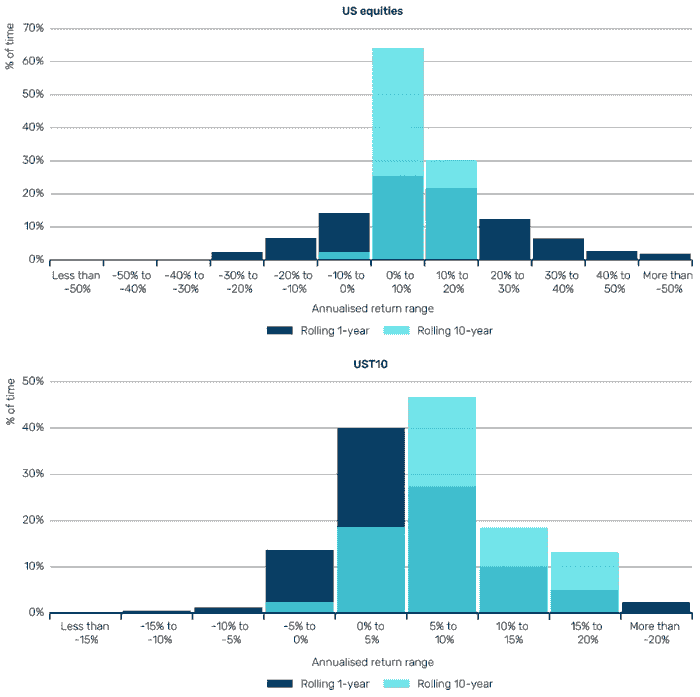

Inherent in CMAs is the idea that asset returns are more predictable on a long-term horizon than on a short-term view. In Figure 1, we show the distribution of one- and 10-year rolling returns to US stocks and bonds, over the ultra-long-term.

- Figure 1. Distribution of returns for US stocks (top) and bonds (bottom), 1800-2024

The conditional historic method

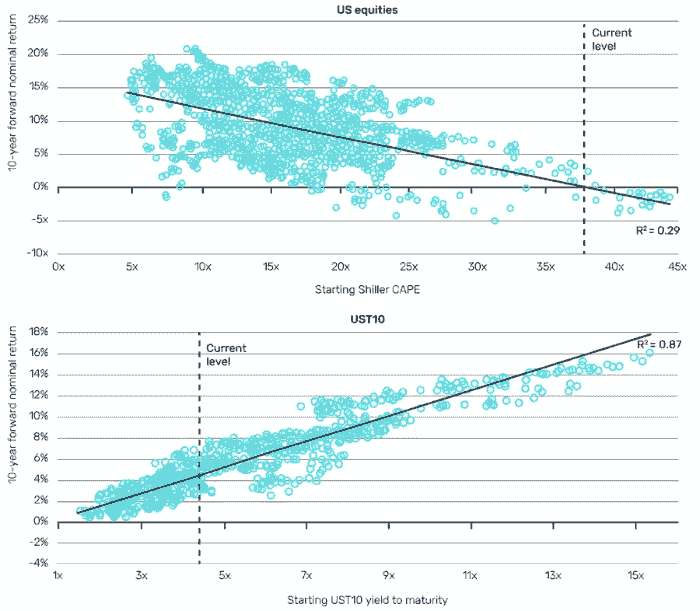

- The conditional historic method takes the same historic data, but conditions it based on starting valuation. It employs the apparent truism that a higher starting valuation should result in a lower forward return. If we take the smoothed earnings yield on equities as a proxy for return, and the same for the yield-to-maturity on US Treasuries, we see an attractive fit between starting valuation and forward return, at least on an overlapping basis

Figure 3. Relationship between starting valuation and 10-year forward return for US stocks (top) and bonds (bottom), 1881-2024